The 5-Minute Rule for Insurance Commission

Wiki Article

The smart Trick of Insurance Asia Awards That Nobody is Discussing

Table of ContentsAn Unbiased View of Insurance CompaniesNot known Details About Insurance Agent Job Description All about Insurance AgentInsurance Meaning for DummiesSome Known Details About Insurance Code Some Ideas on Insurance Agent Job Description You Need To Know

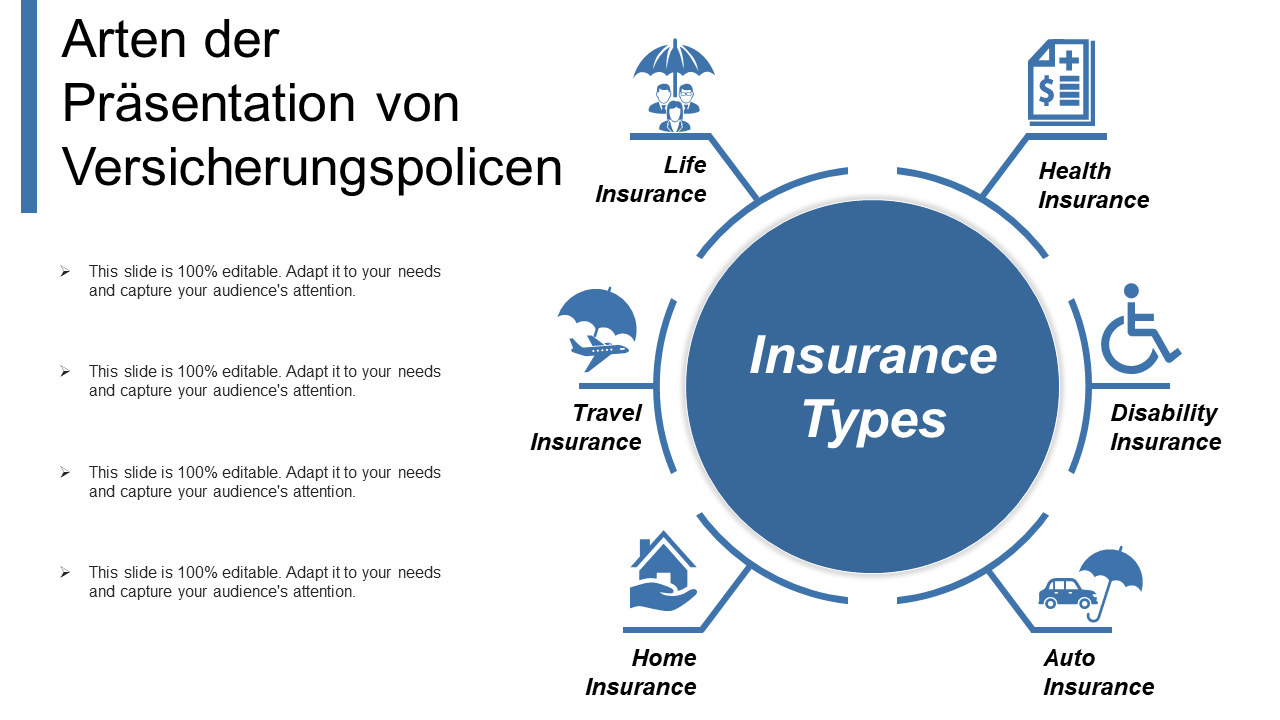

Insurance coverage offers assurance versus the unexpected. You can discover a plan to cover virtually anything, however some are a lot more essential than others. It all depends on your demands. As you draw up your future, these 4 types of insurance should be securely on your radar. 1. Vehicle Insurance policy Auto insurance policy is critical if you drive.Some states also need you to carry individual injury protection (PIP) and/or without insurance driver insurance coverage. These protections pay for medical expenditures associated to the incident for you and also your guests, despite that is at fault. This additionally helps cover hit-and-run accidents and crashes with chauffeurs that don't have insurance policy.

But if you do not buy your very own, your loan provider can acquire it for you and also send you the bill. This may come at a higher price as well as with less coverage. Home insurance policy is a great suggestion also if you've settled your home loan. That's due to the fact that it shields you against expenses for building damages.

The Insurance Account PDFs

In case of a break-in, fire, or disaster, your renter's policy ought to cover a lot of the expenses. It may also aid you pay if you need to remain elsewhere while your residence is being fixed. And also, like home insurance policy, renters uses obligation protection. 3. Health Insurance coverage Medical Insurance is one of one of the most crucial kinds.

Everything about Insurance Expense

You Might Want Special Needs Insurance Too "As opposed to what many individuals believe, their house or automobile is not their biggest property. Rather, it is their capability to gain an income. Yet, lots of experts do not guarantee the possibility of an impairment," stated John Barnes, CFP and also owner of My Domesticity Insurance Policy, in an email to The Equilibrium.You need to additionally assume regarding your demands. Talk with accredited representatives to learn the very best methods to make these policies function for you. Financial planners can give advice about various other typical types of insurance coverage that ought to additionally become part of your monetary plan.

Wellness Insurance What does it cover? Health and wellness insurance is perhaps the most crucial type of insurance coverage.

The 6-Minute Rule for Insurance Commission

You probably do not need it if Every grownup must have health insurance policy. Children are typically covered under one of their parents' plans. 2. Vehicle Insurance What does it cover? There are several different kinds of auto insurance policy that cover different scenarios, consisting of: Liability: Responsibility insurance policy is available in 2 kinds: physical injury and also home damages liability.Injury Protection: This sort of protection will cover clinical expenditures connected to driver as well as traveler injuries. Accident: Collision insurance policy will certainly cover the expense of the damage to your Resources car if you enter into a crash, whether you're at fault or not. Comprehensive: Whereas crash insurance policy just covers damage to your auto triggered by a crash, thorough insurance coverage covers any kind of car-related damage, whether it's a tree dropping on your vehicle or criminal damage from rowdy neighborhood youngsters, for instance.

Always watch for automobile insurance discount rates when you're buying a plan. There are a lot of discounts you may be eligible for to decrease your month-to-month costs, including risk-free vehicle driver, wed driver, as well as multi-car discount rates. Do you need it? Yes! Every state needs you to have car insurance coverage if you're going to drive a vehicle - insurance quotes.

What Does Insurance And Investment Mean?

You most likely do not need it if If you don't insurance debit or credit possess a vehicle or have a vehicle driver's license, you won't require cars and truck insurance. Property Owners or Renters Insurance Policy What does it cover?However, you might require extra insurance coverage to cover all-natural calamities, like flooding, earthquakes, as well as wildfires. Renters insurance policy covers you against damage or theft of personal items in an apartment, as well as in some cases, your automobile. It also covers responsibility prices if somebody was wounded in your apartment or if their personal belongings were harmed or taken from your apartment or condo.

Do you require it? Home owners insurance is definitely essential due to the fact that a home is often one's most beneficial asset, as well as is frequently needed by your mortgage lending institution. Not just is your residence covered, but a lot of your valuables as well as individual items are covered, also. Occupants insurance coverage isn't as critical, unless find out here now you have a big home that has plenty of valuables.

Rumored Buzz on Insurance Agent

It's incredibly crucial.

Report this wiki page